Rome wasn’t built in a day, and today’s money mechanics certainly didn’t come in a single treaty. Our global financial system, like any human system, is not perfect and can be outright cruel and inhumane. We have witnessed injections and bailouts for some, and austerity and social benefit cuts for the poor- that’s money mechanics. Why do the orchestrators of such a system play down or block Bitcoins’ right to exist? Former FED chairman, Alan Greenspan in December of 2013 stated, “I do not understand where the backing of Bitcoin is coming from“. Warren Buffet has referred to Bitcoin as a “mirage“.

Money, as you might imagine has existed since our first human civilization. While the exact origins are a highly debated topic, banking was alive and well thousands of years before coinage even came about. For example, in ancient Mesopotamia clay tablets have been found showing various credit and debits, evidence of organized accounting and trade.

Our human experience is incredibly rich when it comes to money. Throughout our history, man has used clay tablets, sea shells, husks, shark teeth, precious metals and crystals. Sometimes gold and diamonds were used specifically because they are rare, but other times clay ceramic disks were used to remove any preciousness out of money itself- just useless ceramic disks that can shatter to pieces, yet they served as legal tender just as good as gold.

Image of Tally Sticks from England

In England, tally sticks were used from 1100 to 1824. Essentially the sticks are split in half with notches cut along the edge to signify their denomination. One was held in reserve and the other in circulation allowing anyone who returned with it to pay taxes. The system worked so well, it existed for 724 years.

How money is defined, created, by whom, for what, has been a timeless question, and still is at the forefront of geopolitics, economics, philosophy, and our very daily lives. Coming to a single definition of what money is quite a daunting task. And most economists and philosophers will agree that the more you study money, the harder it is to define. History has shown that society has constantly made changes to the definition of money, yet little discourse exists about restructuring money. Money does not really exist in nature, we create it. The act of defining money and organizing the creation of money will define society and make everybody in society bound to its rules. The most famous quote attributed to Rothschild comes to mind: “Give me control of a nation’s money and I care not who makes its laws” — Mayer Amschel Bauer Rothschild. Regardless if he really said or not, one thing can certainly be said about money in general- its the most mysterious, corrupt, and least democratic medium of our day. Just think about it, its main use is to simply facilitate transactions and trade. But as Nietzsche correctly noted, “money is the crowbar of power“. As for the fortunes that usually amass at the expense of others, Honore de Balzac once wrote; “At the base of every great fortune there is a great crime“. Money in essence is abstract social rules embodied in law, those who control its issuance and creation control the rules and laws of literally every member of society. Because of global finance and various trade systems, it is no longer just members of a particular society, but humanity and the planet itself. The debate about money, capital and the role of states and banks is not over by any means. The fierce debate about capitalism and socialism has died down since the Soviet scare dwindeled by 1991, and it seemed the world had enjoyed about 20 years of complete capitalism euphoria- at least until 2008. As the financial bubble burst, markets imploded, and sent the country and the world into financial turmoil, faith based capitalism started shaking. While millions of people lost jobs and homes, the top financial elites seemed to be in quite good shape. The controversial “too big to fail” status and absurdly large bonuses throughout the duration of the bailouts covering that era were a sober reminder who runs the financial show. Fast forward to today and the numbers are clearly out – the top 1 percent have doubled their money since 2009 according to the Wealth X and UBS Billionaire consensus report. And yet again, we might be right around the corner from another round of similar bailouts that favor the big banks who enjoy huge subsidies. The IMF just published a report warning that the “to big to fail” crisis is not yet over, but has gotten worse since the 2008 crisis as the banks consolidated more – knowing quite well, no matter how bad things get, the governments have no option but to keep bailing them out at the expense of rest of society.

Global Finance, Global Frustration

It was hard to digest the obscene robbing of the nation during the financial crisis after 2008, to see the perpetrators of the collapse receive vast amounts of capital, it was though Washington was completely staffed by Goldman Sachs. The frustration turned into one of the biggest protest movements in world history, collectively remembered as “Occupy Wall St” and “the 99%”. Though movement was not centrally organized, the theme was pretty clear: the 99% was getting completely frustrated with the inequality of money so concentrated in the 1% of financial elites and marched to Wall St. The worldwide movement attracted not only disenfranchised youth, but people of all ages and classes, including prominent celebrity figures and academia professors.

Perhaps the most famous crusader today calling for equal opportunities and treatment, questioning our modern consumer capitalism march towards environmental destruction and apathy is Pope Francis. In his address to the church on November 2013, he sent a clear message against the status quo of our global financial system, saying,

“some people continue to defend trickle-down theories which assume that economic growth, encouraged by a free market, will inevitably succeed in bringing about greater justice and inclusiveness in the world. This opinion, which has never been confirmed by the facts, expresses a crude and naïve trust in the goodness of those wielding economic power and in the sacralized workings of the prevailing economic system. Meanwhile, the excluded are still waiting.To sustain a lifestyle which excludes others, or to sustain enthusiasm for that selfish ideal, a globalization of indifference has developed. Almost without being aware of it, we end up being incapable of feeling compassion at the outcry of the poor, weeping for other people’s pain, and feeling a need to help them, as though all this were someone else’s responsibility and not our own.”

Experiments In Money Creation

America has a very fascinating history when it comes to money mechanics and how todays finances came about. As a matter of fact, many of the founding fathers viewed The Bank of England’s fierce desire to control the colonies as a “last straw” and led to the American Revolution – just ask Ron Paul, he knows his money history. Benjamin Franklin was our father of debt free paper money, and it made the colonies very wealthy and vibrant using the colonial scrip which was completely backed by the nation and land itself. England, on the other hand, was already under the European Bankers, though Adam Smith was so apologetically sympathetic towards them in his central banking moral treaty “The Wealth of Nations”, where the western world grabbed the slogan “Invisible Hand” despite the fact that Smith only used it once. Why did Smith argue in favor of private central bankers? It was probably due to the fact that he was loyal to bankers and elites. His young tutor, the Duke of Buccleuch who later married into the Montagu royalty family inspired him to write the “Wealth of Nations” as an apologetic treaty as to why a private charter for central banks should be the best solution for managing the governments money affairs. Smith published his book in 1776, one year after the American Revolution broke out. When Franklin went on a trip to England to discuss these opposing banking interests, he noticed the dire poverty and high unemployment; “The streets are covered with beggars and tramps” noted Franklin.

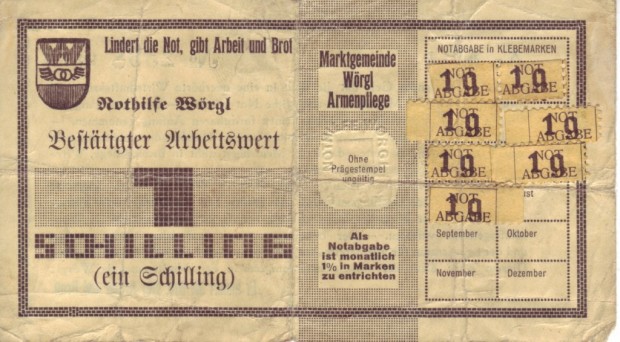

When Lincoln needed to finance a civil war that broke out and wanted to avoid the bankers, he created the Greenback. And it proved to be effective, people gladly accepted the new legal tender, and considered it even better than the paper currency issued by private bankers. But perhaps the most amazing money experiment in recent history occurred in Worgl Austria during the global depression of the 1930’s.

The widely ignored money theorists Silvio Gesell published, “THE NATURAL ECONOMIC ORDER”, John Maynard Keynes believed that Gesell’s theories hold much potential in economic theory, though Gesell himself was not an academic and did not write like the contemporaries of his time. Nevertheless Gesell had a huge impact on the mayor of a small European city and he decided to make a form of scrip or money that actually loses value rather than gain through a form of tax called demurrage. While the rest of Europe was gripped with widespread unemployment, the city’s money supply that Silvio Gesell called Freigeld (translates “free money” in German) was a huge success and drew much attention before the Austrian National Bank abolished it. The city had almost no unemployment, shops were buzzing with business, and they built housing, a reservoir, ski jump and bridge during the year the currency existed- while the rest of the country seemingly gripped with unemployment and economic depression. The currency proved very successful and practical. By creating money that is debt free, and actually taxing the use of money, it makes it depreciative, and the rate at which exchanges occur greatly increased and produced amazing results. Well, apparently too good, and the European Bankers shut it down swiftly. It is refreshing to see, that a relatively new cryptocurrency called Freicoin is based on Gesell’s demurrage concept attracting about a $700,000 market cap and growing.

Defining money is the privilege of those who already control it. But recently, very recently, a debate has broken out, and is giving light to a subject that rarely gets a fair challenge in media or academia. What is money? Where does it come from? Who controls it? How do we define it….

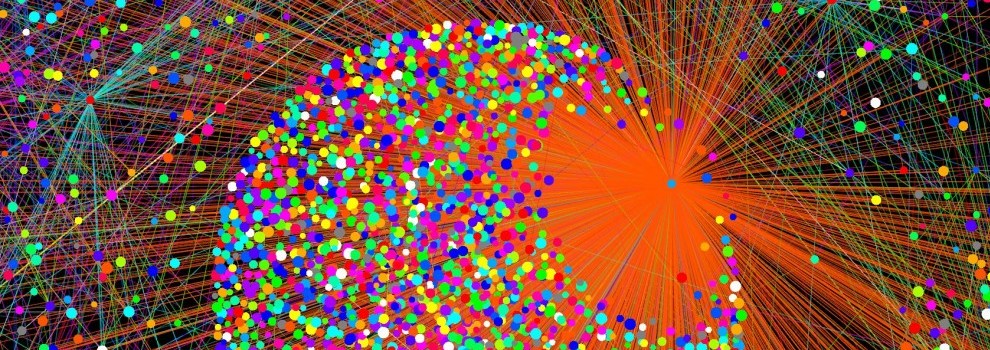

Hello Bitcoin

Various systems have attempted to combat or parallel mainstream currency. In recent history we have seen local currencies, complementary currencies, return to precious metals and even barter itself. But nothing has made more news or raised more eyebrows than Bitcoin, a purely digital currency that is not backed by any entity, organization or government. In short, Bitcoin is basically software code that runs on multiple computers and machines in a peer-to-peer fashion to exchange digital numerations or nodes, verify them, create them, reward machines that create them, and protect them from possible cyber attacks or double spending. This billion dollar industry has no address, no phone number, no email, yet it works, and it’s the most democratic system we’ve seen in modern history. I must admit, Bitcoin is complex. The more you ponder the further you go down the rabbit hole, just realizing how much potential this system has, not only for currency, but decision making, futures, contracts, and our very organization as a global community. Bitcoin today is not the same Bitcoin it was first introduced. The ecosystem of Bitcoin has exploded exponentially not only in use but also in the sheer computing power of Bitcoin. At more than 40 petahashes, the Bitcoin computers plugged into the network around the world are now “hundreds of times greater than the 500 most powerfull supercomputers combined“. This is quite a technological achievement, and it might just be starting. As Bitcoins ecosystem is constantly being layered with complementary technologies, most notably Mastercoin, Ethereum.org and the MaidSafe.net projects. What all of these emerging technologies indicate is that the web of the future, or web 2.0, will be a peer to peer decentralized network, solving todays systemic and ethical issues of privacy, security, centralization and anonymity.

The mysterious origins of Bitcoin, the alleged founder of Bitcoin who went by Satoshi Nakamoto remains anonymous despite many attempts to find him, like the failed Newsweek story, or trace him to perhaps a government entity or financial institution, some of the multiple conspiracy scenarios that constantly brew. What many articles fail to mention was the Satoshi himself as published in his original paper, Bitcoin: A peer-to-Peer Electronic Cash System, stressed a very specific reason for creating the protocol. “The cost of mediation increases transaction costs, limiting the minimum practical transaction size and cutting off the possibility for small casual transaction, and there is a broader cost in the loss of ability to make non-reversible payments for non-reversible services…. These costs and payment uncertainties can be avoided in person by using physical currency, but no mechanism exists to make payments over a communication channel without a trusted party”.

Its seems clear Satoshi was not bent on taking over the world or replacing any currency or bank. There simply exists a technical, bureaucratic hole when it comes to small payments and the options we are given with the current banking-government paradigm. Bitcoin and other cryptocurrencies such as Dogecoin are addressing these issues. Even gas stations sometime won’t let you buy anything under $5. So how are we to participate in our rapid globalization and digital marketplace that is exploding in the micro-payment ecosystem? Can we really legitimize Visa charging us $0.10 plus 2% for such transactions? The need for Bitcoin really does exist just looking at the numbers, say conducting 50 transactions under $0.10. A large portion of fees built into credit cards contain the valid risk of chargebacks, dealing with disputes, reverse payments and security breaches that we have seen such as Target. When thinking about Bitcoin in this mindset, Bitcoin almost becomes a modern day necessity.

Not every government agency is on the same boat when it comes to Bitcoin. For instance there’s Miami PD along with secret service agents conducting sting operations, targeting users of bitcoins who trade bitcoins for cash. After two meetings between agents and localbitcoin users, the agents said the bitcoins will be used to purchase stolen credit card numbers, as the party went forward, they were immediately arrested and were charged with money laundering and running an unlicensed money service business. As if Miami doesn’t have bigger fish to fry than setting people up for trading bitcoins. Many well known figures like Warren Buffett and Alan Greenspan downplay and try to brush off Bitcoin. However, a growing amount of people, from celebrities, to investors are taking on Bitcoin very seriously. Even the Federal Reserve Chair Janet Yellen, who apparently understands bitcoin a bit more, is advising that the FED stay clear from any regulation regarding Bitcoin, since the technology is outside the banking industry and simply cannot be regulated. And then there’s the Vice President of the St. Louis Federal Reserve Bank, David Andolfatto, a FED Bitcoin celebrity rallying colleagues to try to see the benefits of this new technology to his audience of Federal Reserve members showcased a 36-page slideshow/report titled ‘Dialogue with the FED- Bitcoin and Beyond: The Possibilities and Pitfalls of Virtual Currencies”. In Andolfatto’s words, he sees Bitcoin as “a stroke of genius”. Instead of clamping down on Bitcoin, he is advising us to embrace it, and financial institutions must “adapt or die”. Bitcoin is beyond “will it make it” – it already has. Every government agency in the world has heard of Bitcoin, it has a market cap of around $5,598,297,475 USD. In the latest Bitcoin conference held in New York, Barry Silbert who serves as CEO of SecondMarket, a private bitcoin-dedicated investment trust noted that in 2013 Bitcoin received about $100 million into its ecosystem. This year is a game changer, he estimates about $50 million has already been invested in the first quarter of 2014 and sees the year ending in tune of $500 million. Bitcoin opened doors for a plethora of other competing cryptocurrencies called Alt Coins that are trying to carve out their own niche, be it faster transaction time (Litecoin), completely anonymous usage (Zerocoin), demurrage cryptocurrency (Freicoin) or currencies working together on top of the Bitcoin protocol (Mastercoin). Just the other day, the IRS answered my question-saying Bitcoin is not money, but property and thus subject to property gains tax rules. The government bureaucracy is having a hard time understanding the fact that cryptocurrency as a new technology does not need the political process, it already exists, and its built right into the code itself. It’s not that Bitcoin would not benefit from government participation, its just that at this point convincing policy makers to make beneficial policy is difficult because few understand the technology – its like trying to explain to grandmother how to use email and what the internet is for the first time. Mirage or not the wide acceptance of Bitcoin is skyrocketing, sometimes being swapped just for fun, given to charities, kids soccer teams, to national basketball teams like the Sacramento Kings or fly to space thanks to Richard Branson because his Virgin Galactic space travel now accepts Bitcoins. It begs the question: how do IRS officials plan on enforcing capital gains tax when their own kids are swapping Bitcoins on Craigslist for their skateboards or bicycles? Do you think Bitcoin is real money? Whichever way you currently feel, you’re more than welcome to tip me a micropayment, or macropayment, with zero fees or banks associated, something PayPal, Visa or Mastercard does not currently offer. Oh, one last thing: theres no late payments or overdraft fees… Follow me @Pasha Tsiorba

The post Bitcoin & Money appeared first on Bitcoin Magazine.